EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

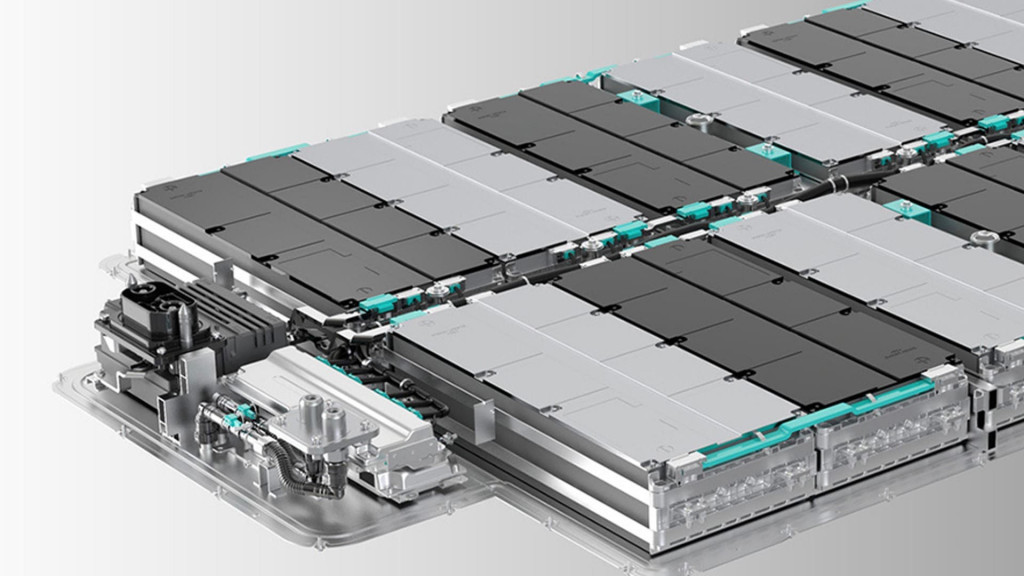

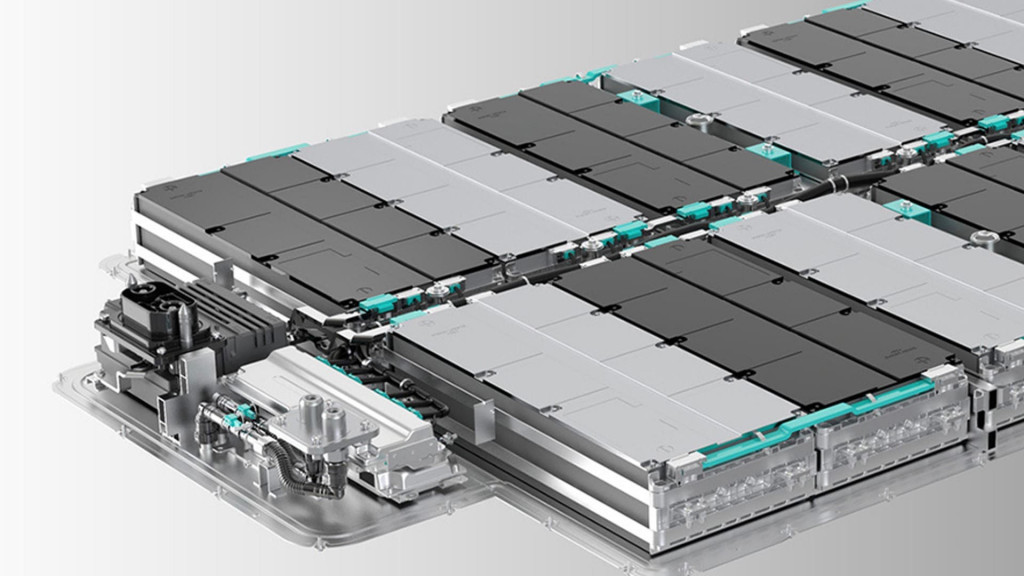

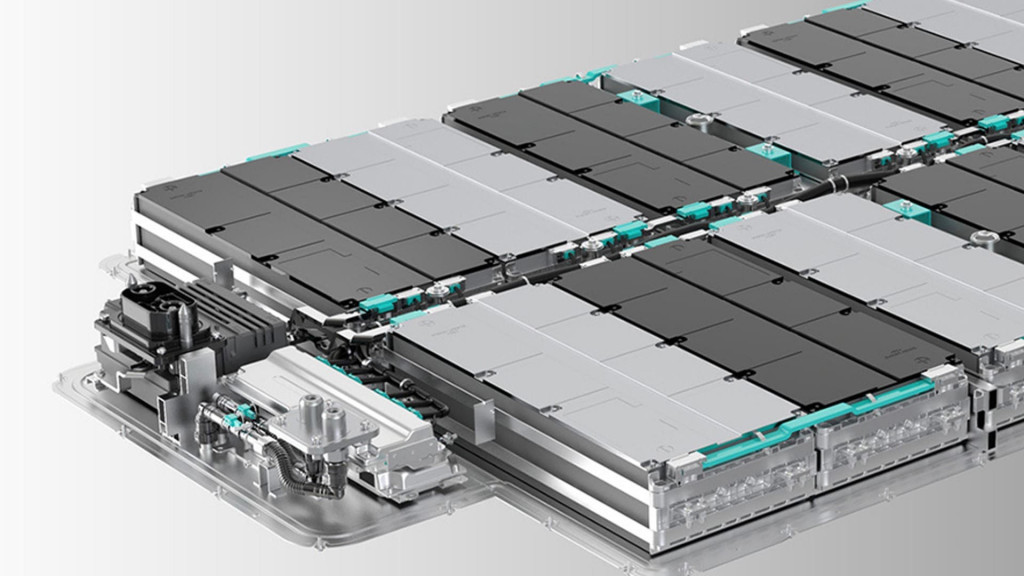

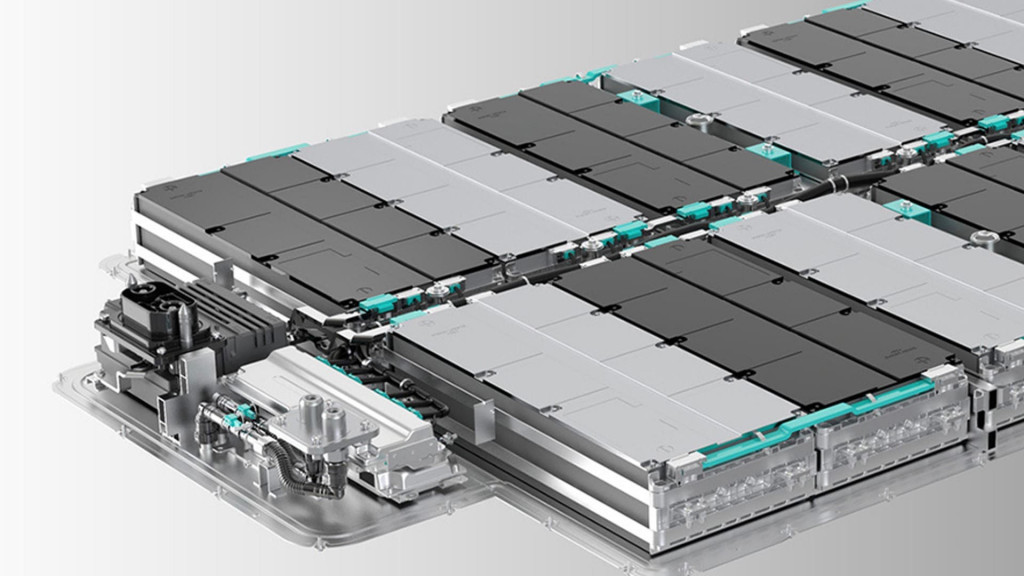

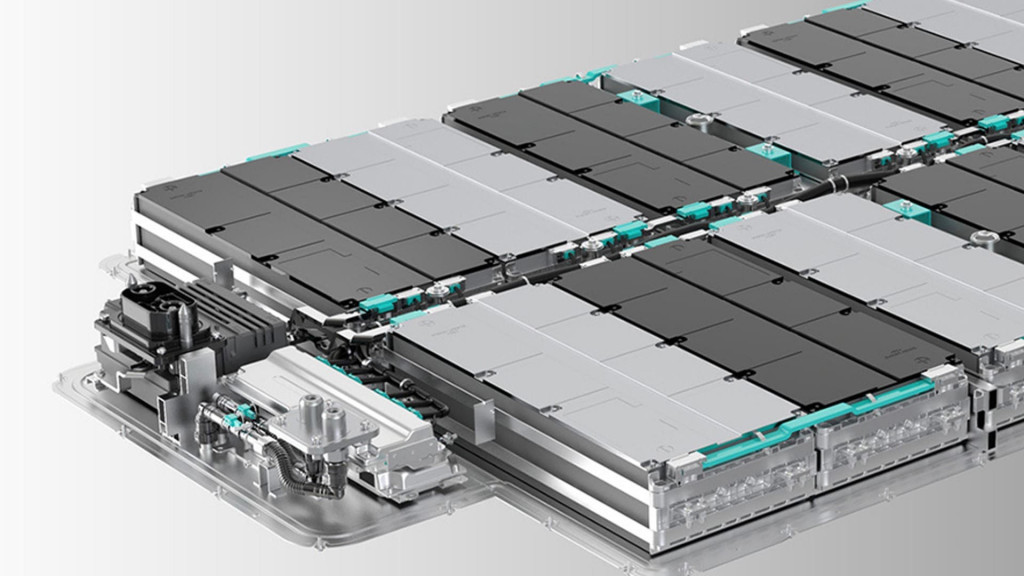

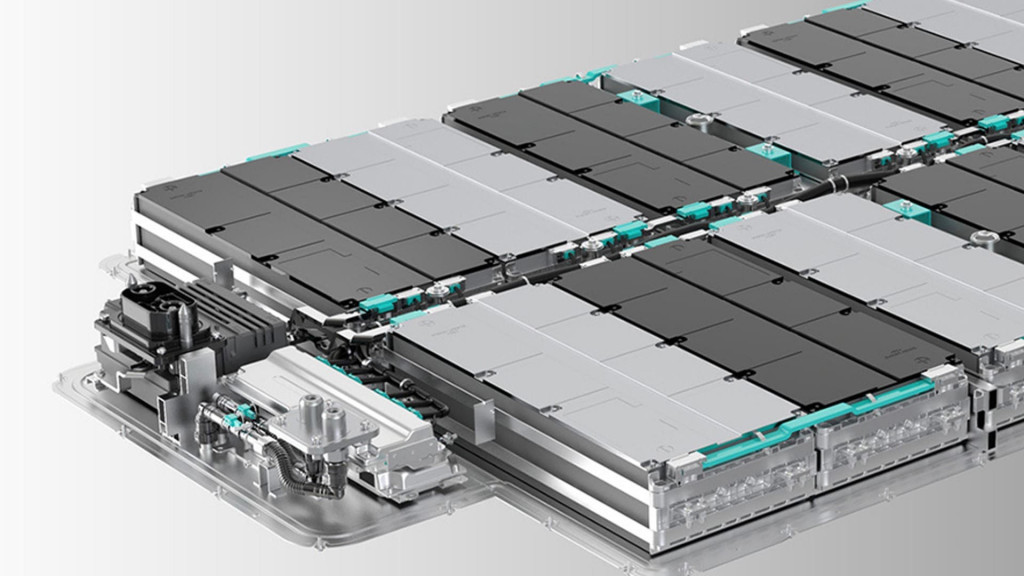

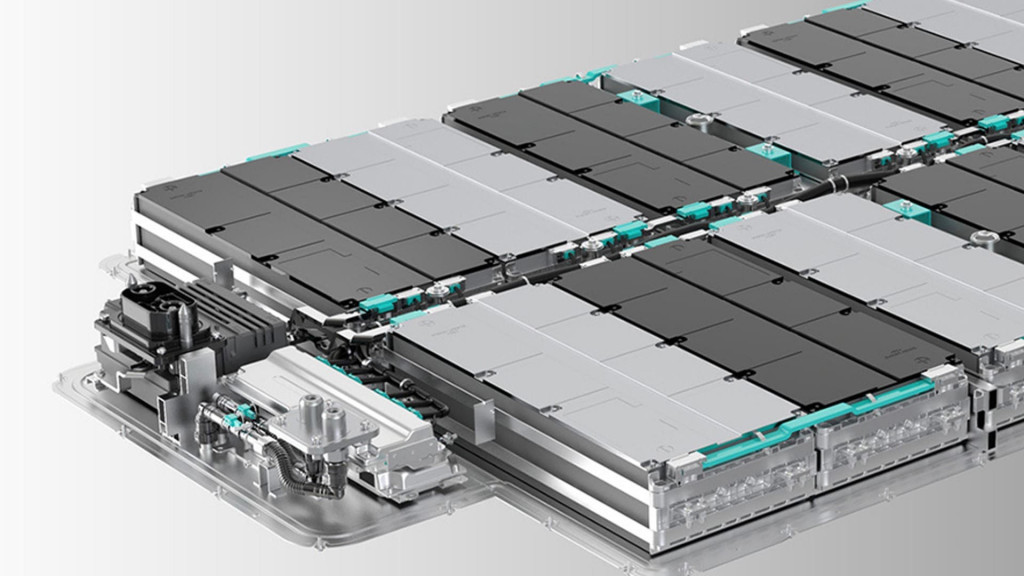

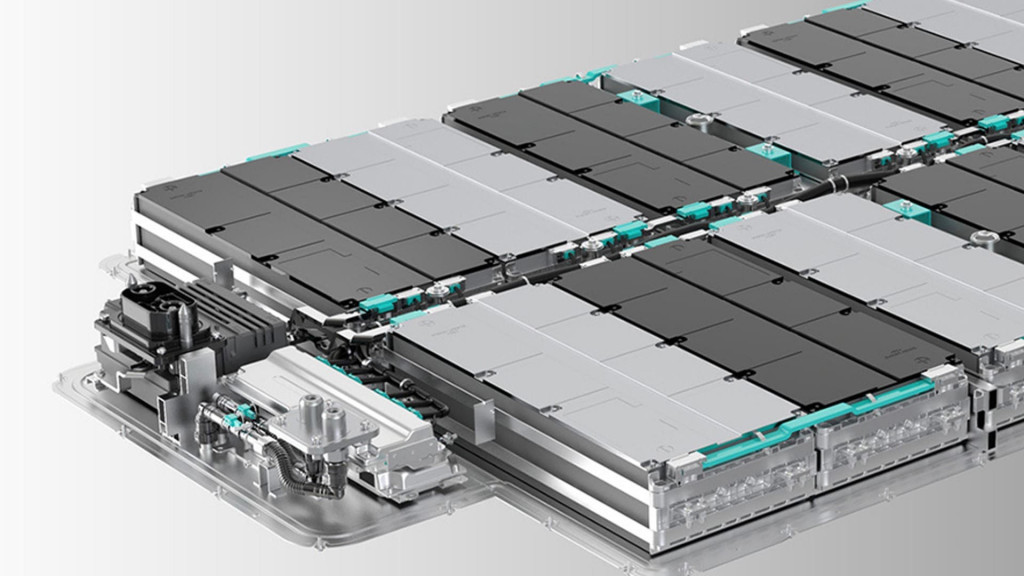

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

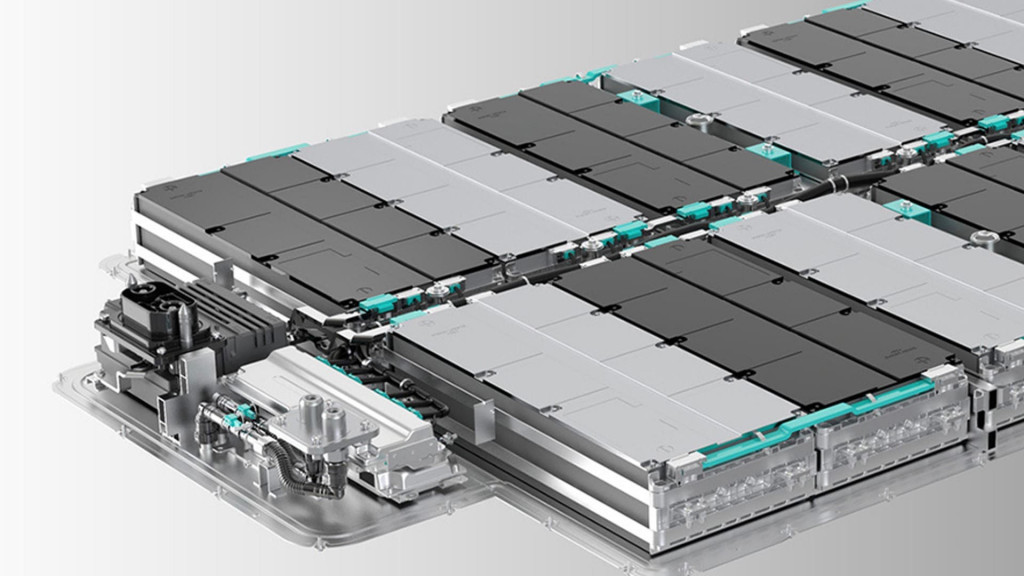

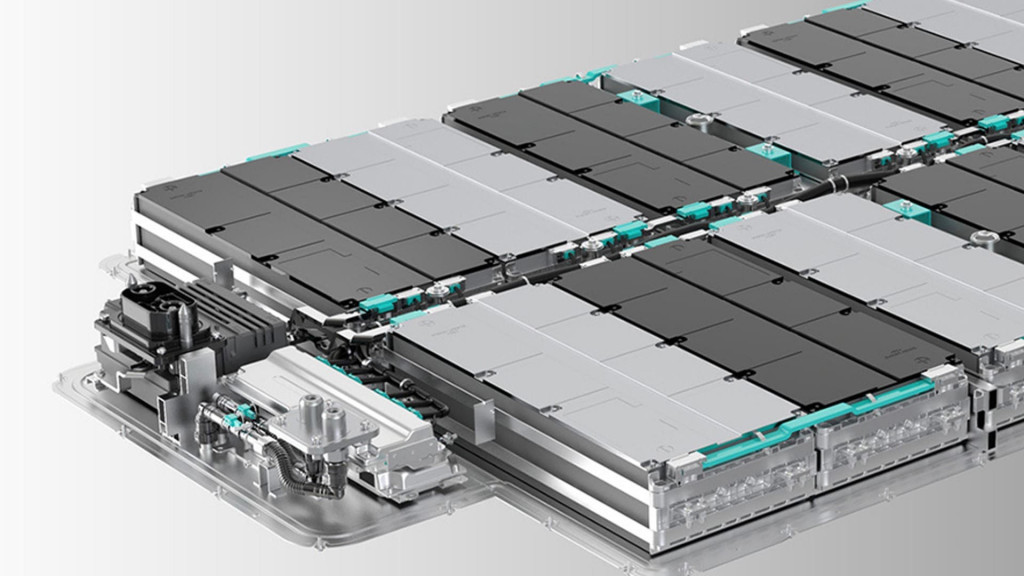

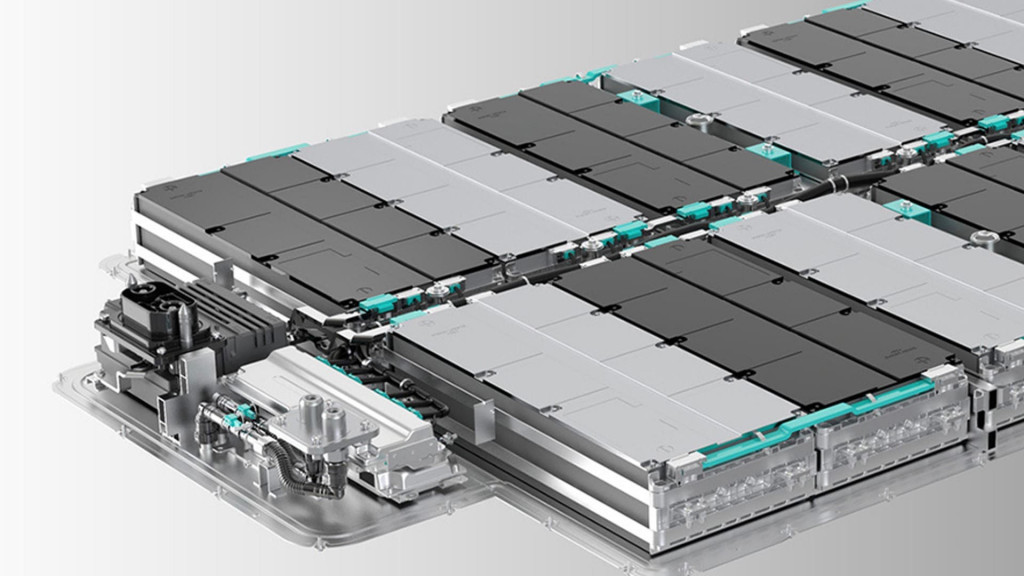

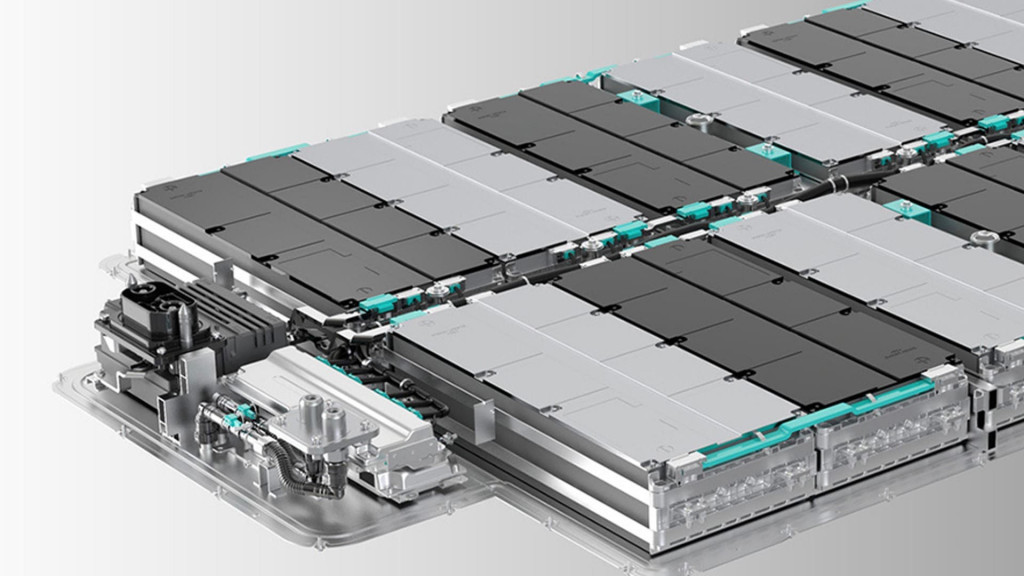

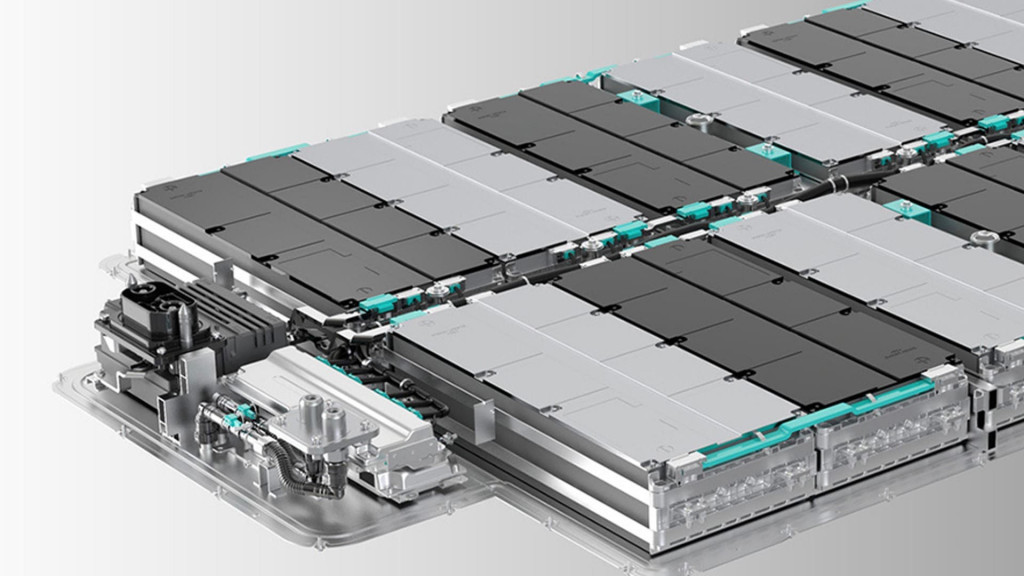

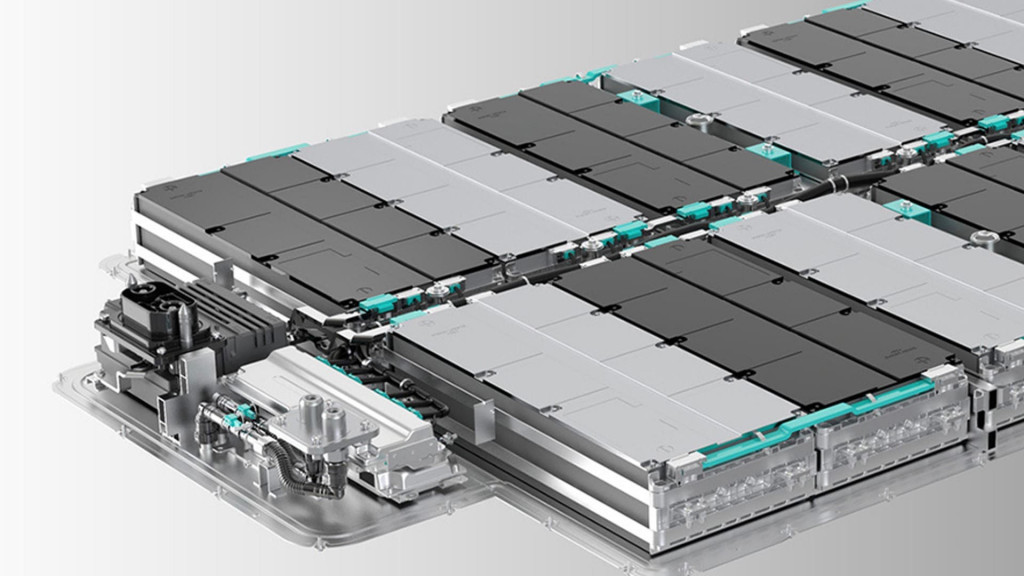

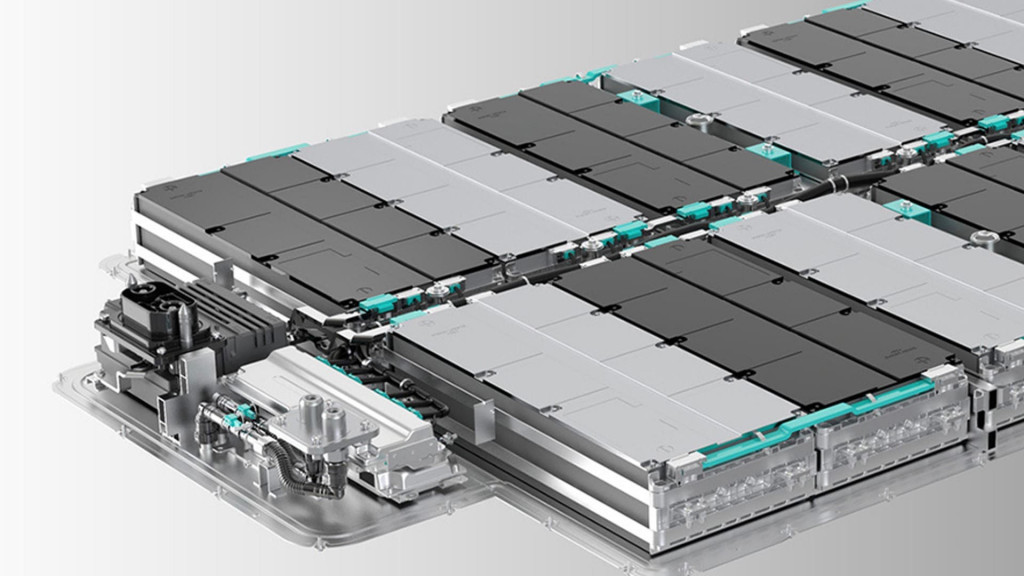

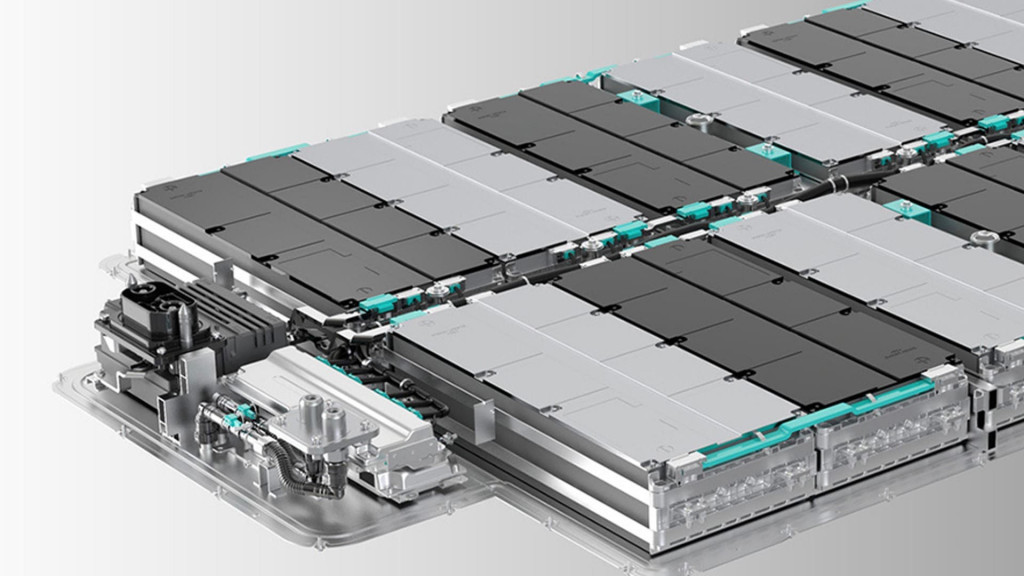

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.

EV battery costs have soared in 2022 due to rising raw material and battery component prices, according to a Bloomberg New Energy Finance (BNEF) report.

The volume-weighted average for lithium-ion battery pack prices reached $151/kwh this year, a 7% increase over 2021, according to the report. It marks the first time average pack prices have increased since BNEF began tracking prices in 2010—and delays EV price parity with internal-combustion vehicles.

That figure represents an average across multiple battery end uses, including different types of electric vehicles, buses, and stationary energy storage, BNEF noted, adding that the specific average for EV packs was $138/kwh in 2022.

Nio 100-kwh battery pack

Average prices could have been even higher in 2022 if not for increased adoption of the lower-cost lithium iron phosphate (LFP) chemistry as an alternative to the nickel manganese cobalt (NMC) used by many manufacturers. On average, LFP battery cells were 20% cheaper than NMC cells, in part because they don’t require cobalt, one of the raw materials that saw significant prices increases in 2022, according to BNEF.

However, overall cost increases outpaced the increased adoption of LFP chemistry, according to BNEF. LFP also wasn’t immune to rising costs. On a pack basis, prices rose 27% in 2022, BNEF reported.

Battery price increases also come despite many recent battery manufacturing announcements, which will eventually increase supply but haven’t begun to affect the market yet. BNEF expects the market to stay on its current trajectory in 2023, predicting average pack prices of $152/kwh.

GM Ultium battery – cell stacking

BNEF expects battery costs to start dropping again in 2024, when more lithium mining and refining capacity will be online, reducing prices. It also predicts that batteries will hit $100/kwh—generally considered the point at which EVs can achieve price parity with gasoline cars—in 2026.

That prediction shows how far recent price spikes have set back EV affordability. Just a year ago, BNEF predicted that EV battery costs would fall under the $100/kwh mark in 2024. Wood Mackenzie, earlier in 2021, agreed—but it said $60/kwh is the real target for pushing EVs past cost parity with gasoline vehicles. That will help bypass the idea that EVs might still cost more to build, battery aside.

Ipsos, in 2020, found that cost, more than charging, was the biggest barrier to EV adoption. That was mostly before the surge of the past two years that’s affected new and used EV prices, however.