Hikvision DS-2CD2546G2-IS – 4MP AcuSense Mini Dome Netwerk Camera met vaste lens 2.8MM voor de beste prijs | VisionSegurPlus

1080p Hd Poe Mini Ip Camera Miniature Poe Camera Audio Ip Network Camera P2p Wide Angle Power Over Ethernet Ipc Web Cam - Ip Camera - AliExpress

1080P Home Security Ip Camera Wifi Draadloze Mini Netwerk Camera Surveillances Wifi V380 Nachtzicht Camera Babyfoon| | - AliExpress

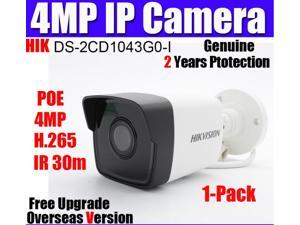

Hikvision 4MP Bullet Camera DS-2CD1043G0-I 2.8mm POE IP Network Bullet Camera with EXIR 98ft Night Vision, Smart H.265 WDR, VAC, SD Card Slot, ONVIF, IP67 IK10 Support ONVIF ISAPI, 1Pcs - Newegg.com

Hikvision DS-2DE3204W-DE - 2MP Mini PTZ Dome netwerk camera 4x zoom dé specialist in IP-beveiligingscamera's

Hikvision DS-2CD2586G2-I – 8MP AcuSense Mini Dome Netwerk Camera met vaste lens 2.8MM voor de beste prijs | VisionSegurPlus

Micro Wifi Mini Camera Hd 1080p With Smartphone App And Night Vision Ip Home Security Video Cam Bike Body Dv Dvr Magnetic Clip - Buy Wifi Mini Camera,Hidden Camera With Smartphone App,Home